IRS W-4V 2018-2025 free printable template

Show details

See How Do I Stop Withholding below. Sign this form. Form W-4V is not considered valid unless you sign it. Give the new form to the payer. How Do I Stop Withholding If you want to stop withholding complete a new Form W-4V. For withholding on social security benefits give or send the completed Form W-4V to your local Social Security Administration office. Form W-4V Voluntary Withholding Request Rev. February 2018 For unemployment compensation and certain Federal Government and other payments....

pdfFiller is not affiliated with IRS

Instructions and help about the W4V Withholding Form

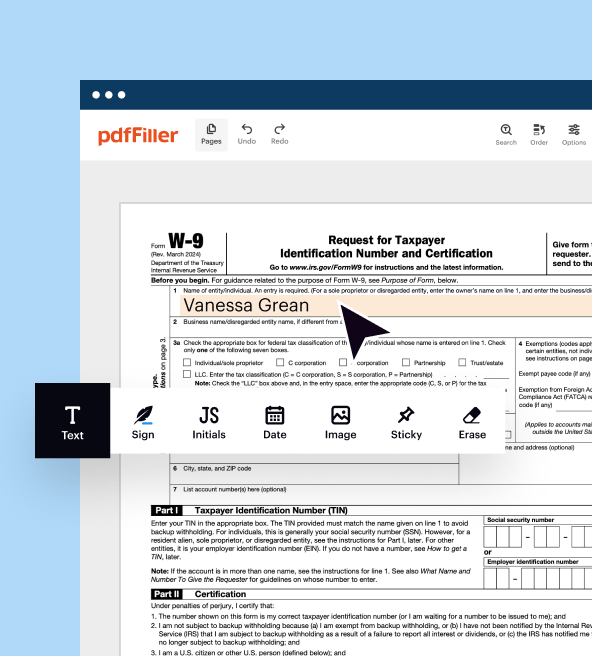

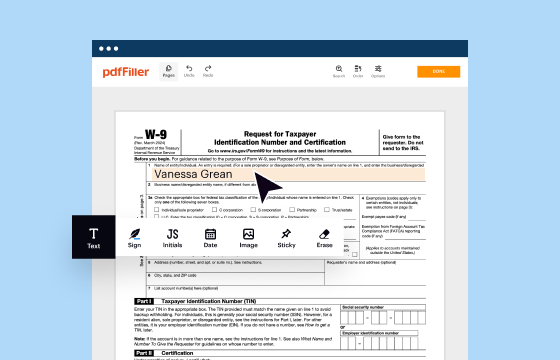

How to edit the IRS Form W 4 V online

Here’s how to easily prepare and edit your voluntary withholding request online:

How to fill out the w 4v voluntary withholding request

Video instructions and help with filling out and completing the W4V tax form

Instructions and help about the W4V Withholding Form

Here, you will find practical walkthroughs on how to properly complete your fillable W 4V Form and effortlessly edit the document using pdfFiller. Follow these tips to handle your tax paperwork accurately and get it done in no time!

How to edit the IRS Form W 4 V online

Filing taxes can be stressful, but online tools can significantly simplify this process. With professional platforms like pdfFiller, you can efficiently manage your tax reports and save time on their preparation.

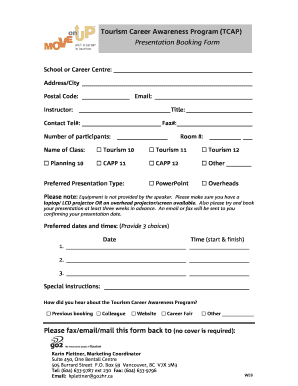

Here’s how to easily prepare and edit your voluntary withholding request online:

01

Click Get Form at the top of this page to open the template in the editor.

02

Read the IRS instructions on document completion to fill out the blanks correctly.

03

Use the Text and Check/Cross tools to provide the requested information.

04

Make other adjustments if necessary using the upper toolbar.

05

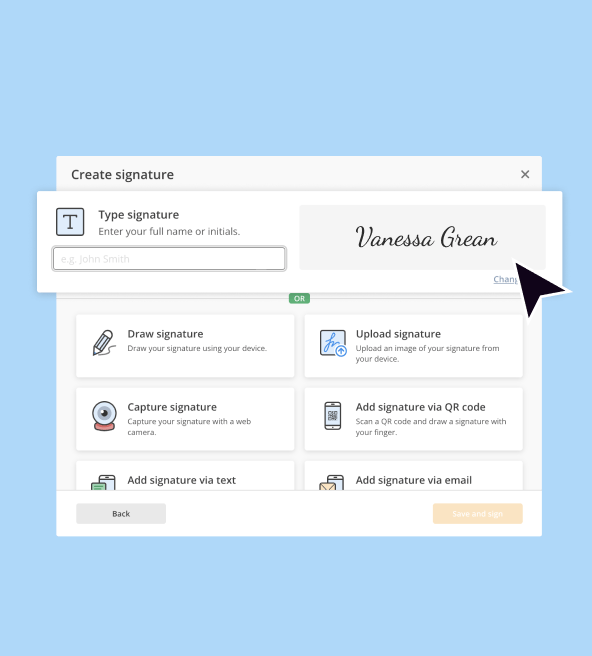

Click Date and Sign to create your electronic signature by typing, drawing, or uploading its image.

06

Click Done to finish and sign up with pdfFiller, starting a 30-day free trial.

07

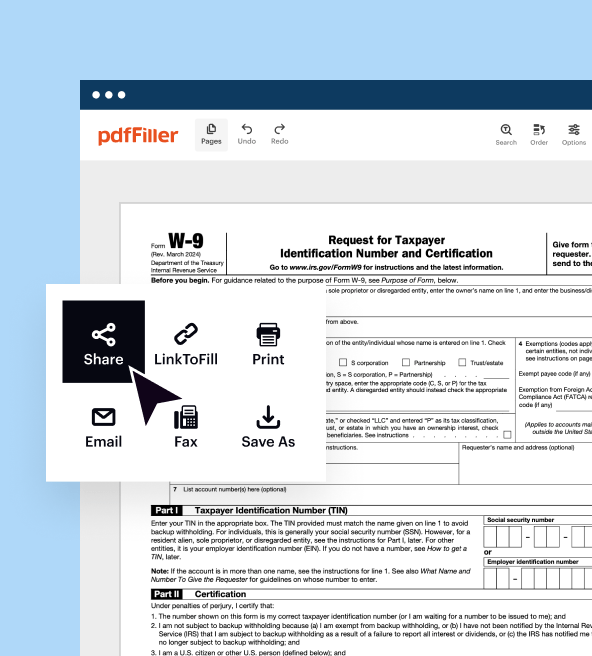

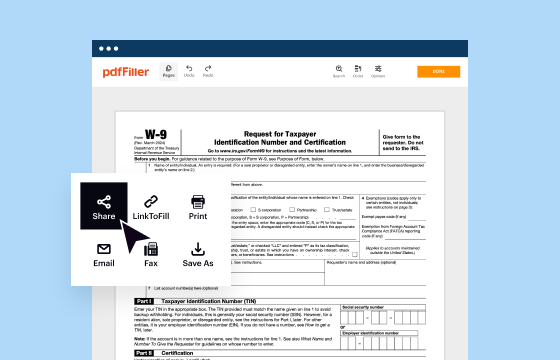

Print, fax, or email your completed IRS Form W 4V, download it, or export to the cloud.

pdfFiller is one of the best solutions for online document management that will help you prepare, file, and store your tax documentation securely and efficiently. Give it a try now!

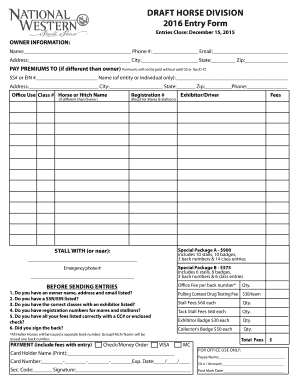

How to fill out the w 4v voluntary withholding request

Completing a voluntarily withholding request will take little time, as it requires minimum information from the applicant. Our guide and the official instructions from the Internal Revenue Service, published at the top of the document, will help you finish it right and fast.

01

Enter your personal information (first name, middle initial, and last name) and Social Security Number in Lines 1 and 2 accordingly.

02

Provide your home address in Line 3 (number and street or rural route, your city, state, and ZIP code). If you live outside the U.S., write the name of the country without abbreviations.

03

In Line 4, enter the claim or identification number you use with your payer. It may or may not be your own SSN. Contact your payer to check the correct number you need to use.

04

Check the empty box in Line 5 if you want federal income tax withheld from your unemployment compensation at a rate of 10% of each payment.

05

Mark the correct box on Line 6 to specify your desired withholding percentage if you are receiving other government payments.

06

Mark the box in Line 7 only if you want to stop federal tax withholding from your payments. When making this request, you can disregard Lines 5 and 6.

07

Verify your answers before signing your paperwork. Then, add your signature and the date of signing in the relative placeholders.

Video instructions and help with filling out and completing the W4V tax form

Show more

Show less

Last updates to Form W 4V 2025

Last updates to Form W 4V 2025

The most recent review of this tax form occurred in February 2018. During this update, the IRS adjusted the percentage rates for tax withholding on government payments specified in Line 6. The rates, previously set in the 2014 revision as "7%, 10%, 15%, or 25%," were revised in 2018 to "7%, 10%, 12%, or 22%." Since then, there have been no additional changes to the preparation or filing requirements for this tax document.

All you need to know about the W4V withholding form

What is Form W 4V?

Who needs Form W 4V 2025?

What information do I need to provide in Form W 4V?

Is Form W4V accompanied by other forms?

When is the W4V withholding form due?

Where do I send my printed Form W 4V?

All you need to know about the W4V withholding form

Grasping the process for willingly claiming tax withholding is essential for individuals receiving certain government payments. This guide will help you navigate its purpose, requirements, and submission process to ensure proper tax withholding and compliance.

What is Form W 4V?

Form W 4V, known as the "Voluntary Withholding Request," is a document allowing individuals to opt for federal income tax withholding from certain government payments, even when it's not legally mandated. These benefits include:

01

Unemployment compensation, including Railroad Unemployment Insurance Act (RUIA) payments

02

Social security benefits

03

Social security equivalent Tier 1 railroad retirement benefits

04

Commodity Credit Corporation loans

05

Certain crop disaster payments under the Agricultural Act of 1949 or Title II of the Disaster Assistance Act of 1988

06

Dividends and other distributions from Alaska Native Corporations to shareholders.

Submitting the SSA Form W 4V enables you to request tax withholding to meet federal tax obligations, helping to prevent underpayment at the end of the tax year.

Who needs Form W 4V 2025?

This IRS document is for individuals who are not typically subject to income tax withholding but wish to have taxes deducted. It is often utilized by retirees, self-employed individuals, pension or annuity recipients, and those making periodic payments.

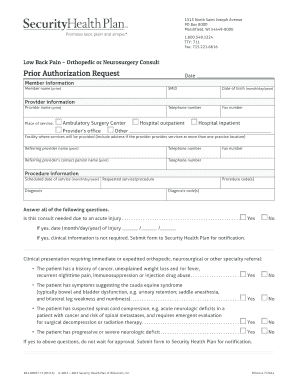

What information do I need to provide in Form W 4V?

Check the guidelines provided at the beginning of the document before completing it. To submit the Voluntary Withholding Request, you must provide the following information:

Your full name, including your middle initial.

Your home address, including city/town, state, ZIP code, and the name of the country (non-abbreviated) if you live outside the U.S.

Your Social Security Number (SSN).

The claim or identification number associated with your payer. This number is linked to the claim or payment and may differ from your SSN. If you are unsure which number to use, contact the Social Security Administration at +1-800-772-1213. For other government payments, consult your payer for the correct number.

The type of payment from which you wish to withhold taxes.

The percentage of each payment to be withheld for federal taxes, with options of 7%, 10%, 12%, or 22%.

Please remember that your paperwork is not valid until you properly sign it.

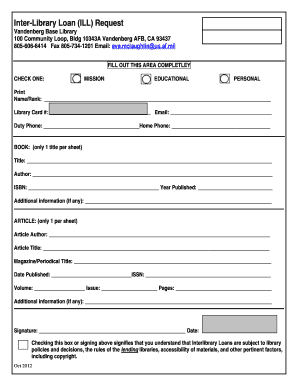

Is Form W4V accompanied by other forms?

This is a standalone document for voluntarily withholding federal income tax from certain government payments. It typically does not need to be accompanied by other tax paperwork.

When is the W4V withholding form due?

There’s no specific deadline for this application. You can submit it anytime throughout the year if you wish to have federal income tax withheld from your government payments. It’s recommended to submit the document as soon as you decide that withholding is necessary to ensure timely processing and effective management of your tax liability.

Where do I send my printed Form W 4V?

Submit the completed W-4V withholding claim directly to the benefits payer, don’t send it to the IRS. Check the address where to mail Form W 4V on the official website of the entity providing your benefits. For instance, if you receive Social Security benefits, send your request to your local Social Security Administration office. You can find the Social Security office closest to your home by the ZIP code here. For other payments, check the mailing address on the appropriate benefit payer’s website.

Show more

Show less

FAQ

Can I fill out my Form W 4V electronically?

Yes, you can use online document management platforms, like pdfFiller, to complete your Voluntarily Withholding Request electronically on any internet-connected device. You only need to register an account (a 30-day free trial is available), upload your document, and quickly fill out the blanks. The editor features a field marker that navigates you through the document fields, helping you avoid missing any questions.

Where can I get Form W 4V?

This document is available for download in PDF format on the IRS website. Alternatively, you can access the IRS Form W-4V printable blank from the pdfFiller template library, allowing you to easily fill it out and sign it electronically on the platform. Additionally, pdfFiller offers the convenience of printing your documents, faxing them, or mailing them via USPS directly from the editor with just a few clicks.

Can I print my own Form W4V?

Sure. Once you complete and sign your voluntary withholding request in pdfFiller, click Done and find the Print option on the right-hand panel of your Dashboard. Instantly get the printed copy of your withholding request or send it directly to your benefit payer via the USPS without printing the document and leaving the editor.

Can I submit a W 4V form online?

There’s no information about e-filing mentioned in the form W 4V instructions. Therefore, you should print and file your completed withholding claim to your benefit payer by fax or regular mail. These options are also available in pdfFiller to facilitate your document preparation process.

How do I download the W 4V PDF file?

Navigate to the IRS website and download the latest document version. If you use pdfFiller for your document management tasks, simply click Get Form at the top of this page to upload the template to your Dashboard. Click Save as in the right-hand panel and download the file on your device.

How do I send the W4V to the Social Security Administration?

The Social Security Administration accepts the completed W4V by fax or mail. You can locate the SSA office closest to your house by entering your ZIP code on this page. Use their contact information to file your withholding request.

What is the penalty for filing the IRS Form W 4V late?

This document has no specific filing deadline like tax returns, so there is no penalty for submitting it "late." You can submit it once you decide to adjust the withholding from your government payments. However, any delay in submission means the changes to your withholding will take longer to take effect, impacting your overall tax situation.

How can I modify my W4V template without leaving Google Drive?

It’s simple if you use the pdfFiller’s add-on for Google Drive. Install it from Google Workspace Marketplace, connect your accounts, and enjoy the ability to instantly open your Google documents in our editor with a single click. There is no need to switch between multiple tools or waste time downloading and uploading files. Fill out, edit, sign, and share your documents efficiently with pdfFiller.

How can I edit my voluntarily withholding request on an iOS device?

You can effortlessly do it with pdfFiller's app for iOS devices. Install the application from the App Store, register with pdfFiller, and start a 30-day trial that gives you free access to all editor's advanced capabilities for this period. Upload your withholding request, make the required edits, and then download, print, or share your completed copy with just a few clicks.

How can I edit my Social Security tax withholding request on an Android device?

pdfFiller offers comprehensive applications for Android and iOS devices. Register with our platform, start a 30-day free trial, and download the pdfFiller app for Android on Google Play. Enjoy the simplicity and efficiency of completing, modifying, and eSigning your paperwork on a mobile device, printing it, faxing it, or mailing it via the USPS directly to the tax office right from the app.

Fill out Form W 4V